|

Trend & Cycles Direction indicators

TCD package consists of the following indicators:

Equity – Base of the system, uses data of other TCD indicators to detect market cycles and trends and to filter incorrect signals. Indicates current equity value using signals of dominant cycles trend. Generates the dominant cycle signals.

Equity Oscillator – Indicates profit or loss level of opened position using Dominant cycles trend signals. Very useful for stop-loss and trailing-stop determining and profitability analysis. Shows loss or profit of current position

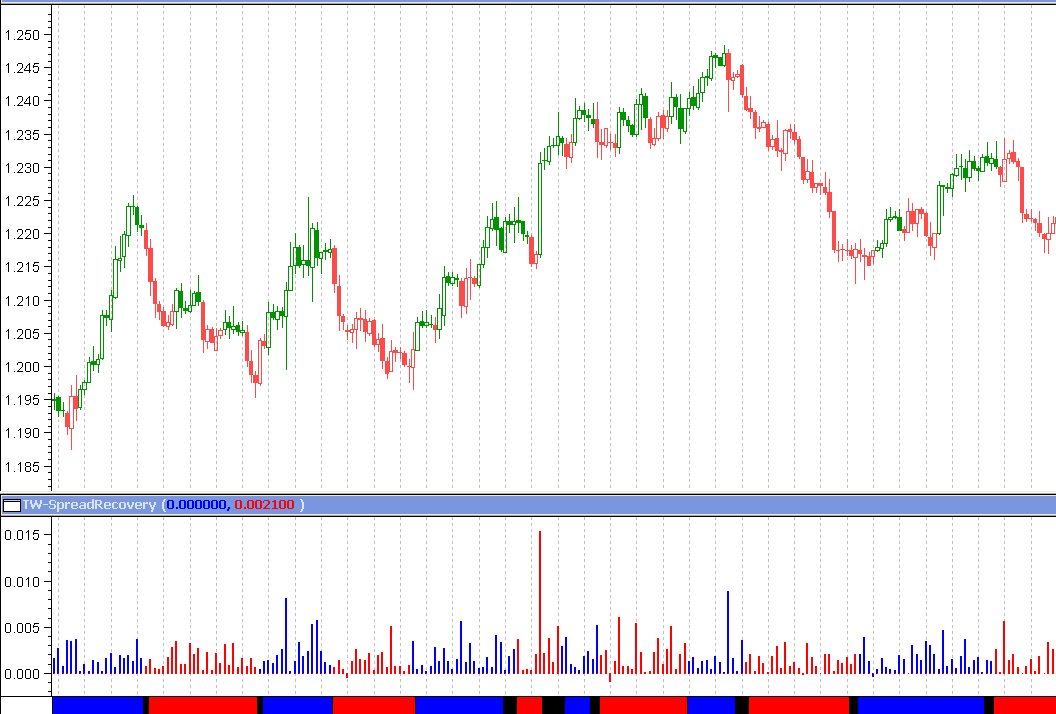

SpreadRecovery – indicates High deviation of current bar from Close of previous bar, if dominant cycle is bullish. Or Low of current bar from Close of previous bar, if cycle is bearish. Indicator recovers spread or commission on position opening

For trend detection we use modified index of random guessing. This index is based on statement: “Price changes are random vibration of long-term trend”. According to analysis of long-term fluctuations, random guessing index gives signals when trend changes its volatility and Equity oscillator reacts in a moment, indicating in expert commentary all guidelines, while modified RWI oscillator filters all false signals.

Indicator of Polarized Fractal Dimension is used for detection of trend and its power. PFD is based on fractal model. Analyzing fractals indicator detects trends and dominant tendency in traders activity.

Detection of Dominant Cycle

Classic methods of analysis, based on Fourier transform are ineffective on financial markets. Today many traders use MESA methods ( Maximum Entropy Spectral Analysis ). Using MESA is very easy to detect exactly one of market conditions ( cycle vibration, trend following or chaotic instability because of external influence). That’s why our “Dominant Cycle” ( D-Cycle oscillator) is based on MESA method.

Exponential Smoothing Filter normalizes Data from all TCD oscillators ,that makes system more rapid and increases system functionality

TCD system, based on MESA method gives You great advantage in compare with Your competitors who use classic technical analysis

|

Our products

Our products

Our products

Our products